Exciting updates are transforming the mortgage landscape in Canada, making it easier than ever for first-time buyers to achieve their dream of homeownership!

Here’s what’s new:

The maximum property value eligible for insured mortgages has increased from

$1 million to $1.5 million, allowing buyers to explore higher-priced homes with a down payment of less than 20%.

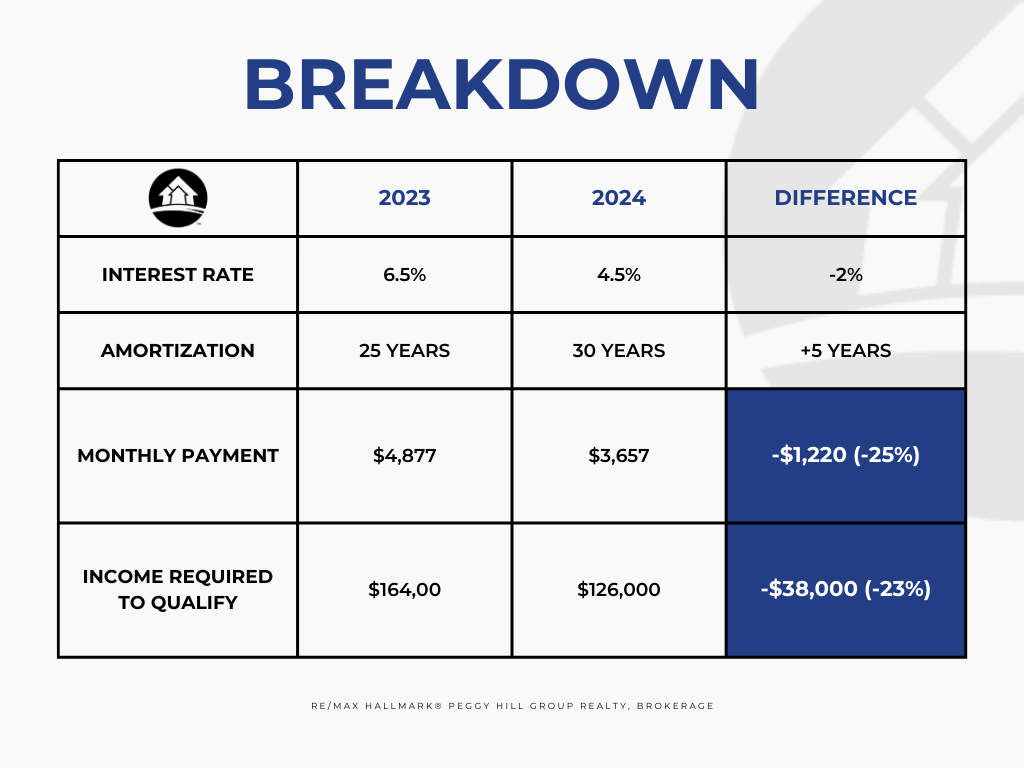

More Canadians are now eligible for 30-year mortgage amortizations, including all first-time homebuyers for new builds for resale. This change significantly reduces monthly payments, making homeownership more attainable.

Mortgage holders switching to another lender upon renewal (under the same loan amount and amortization schedule) will no longer need to undergo a stress test, making it easier to find competitive rates and terms.

The fifth consecutive rate drop in 2024! The Bank of Canada has lowered the overnight lending rate by 1.75% since June of this year.

Below, we break down how these changes are making homeownership more affordable.

With lower lending rates and these new mortgage rules, now is the perfect time to find your #HomeToStay! We’re here to guide you through every step of the process, ensuring a smooth and rewarding experience as you find the perfect place to call home.